Why Your Annual Operating Plan Is A Lie and What To Do About It

Imagine you’re a CIO, CTO, IT Leader, or Finance Manager. You prepare an annual operating plan outlining your budget and allocations every year. Once the dust settles and everything is agreed to, you are asked to do more with less. Everything after that is chaos.

WHERE THE PLAN GOES WRONG

- Projects that you targeted did not start when you planned.

- Unplanned events, outages, and work eat at the money you planned to invest in a new value.

- Projects you started in prior years do not finish on time, and an ever-increasing body of work carries into the new year. Since this work is already committed, it erodes the amount of money and effort that can be applied to new, high-value products and features.

- You are met with a barrage of requests—large and small—from your customers, and their need outstrips your capacity to deliver. It’s difficult to prioritize these requests because there is no consistent definition of value, and nobody believes the business cases anyway.

- At some point, one or more frustrated customers will come to you with a pile of cash to execute their latest priority. But being given funds doesn’t magically make skilled, trained, and experienced resources appear to do the work. Inevitably you move around the same people who always get the job done, leading to more things being started but not finished.

- You are given unfunded mandates related to risk, compliance, and cyber security.

HOW DID WE GET HERE?

This sounds like a terrible fate. Unfortunately, it’s a fate that many companies struggle with every year.

A primary cause for this is the belief that:

- Everyone agrees on priorities

- A year is defined by a set of projects

- The projects can be planned in detail

- The full scope of each project can be delivered on time

- The business will not change what it wants over the course of the year

- People can be moved around to address gaps

- People can be added on demand when funding becomes available

Every system (in this case, your “people system”) will deliver exactly what it is designed to deliver.

What if we could organize that system in such a way to make execution aligned to the most important objectives the company has? Could we create an annual funding plan but use it to adaptively deliver a higher density of value? Can we organize ourselves as stable, high-performing, cross-functional teams? Can we develop the muscles to change our allocation of investments to meet the emerging needs of the business? What if everyone in the company was operating against a small, clear set of objectives with measures that show if they will be achieved and provide feedback loops to adapt to change?

The answer is yes! It is possible to plan finances for the year while being crystal clear on strategic objectives and achieving them.

WHAT DO WE DO ABOUT IT?

First, it is necessary to believe that a year is not defined by a list of projects but rather by an Investment Strategy: an organization of stable, cross-functional teams with aligned value, funded for reasonable intervals against strategic objectives.

One definition of strategy is the alignment of necessarily finite resources against potentially unlimited aspirations. What is important is not whether projects are finished but whether business objectives are being met.

These are some questions we ask:

- Are we growing our most important markets?

- Do we understand our customers and their problems?

- Can we provide solutions to those problems?

- Do we have effective designs for those solutions?

- Can we deliver those solutions?

- Are there feedback loops all along the way to listen and respond?

ESSENTIALS FOR AGILITY: TEAMS, BACKLOGS, AND WORKING TESTED PRODUCT

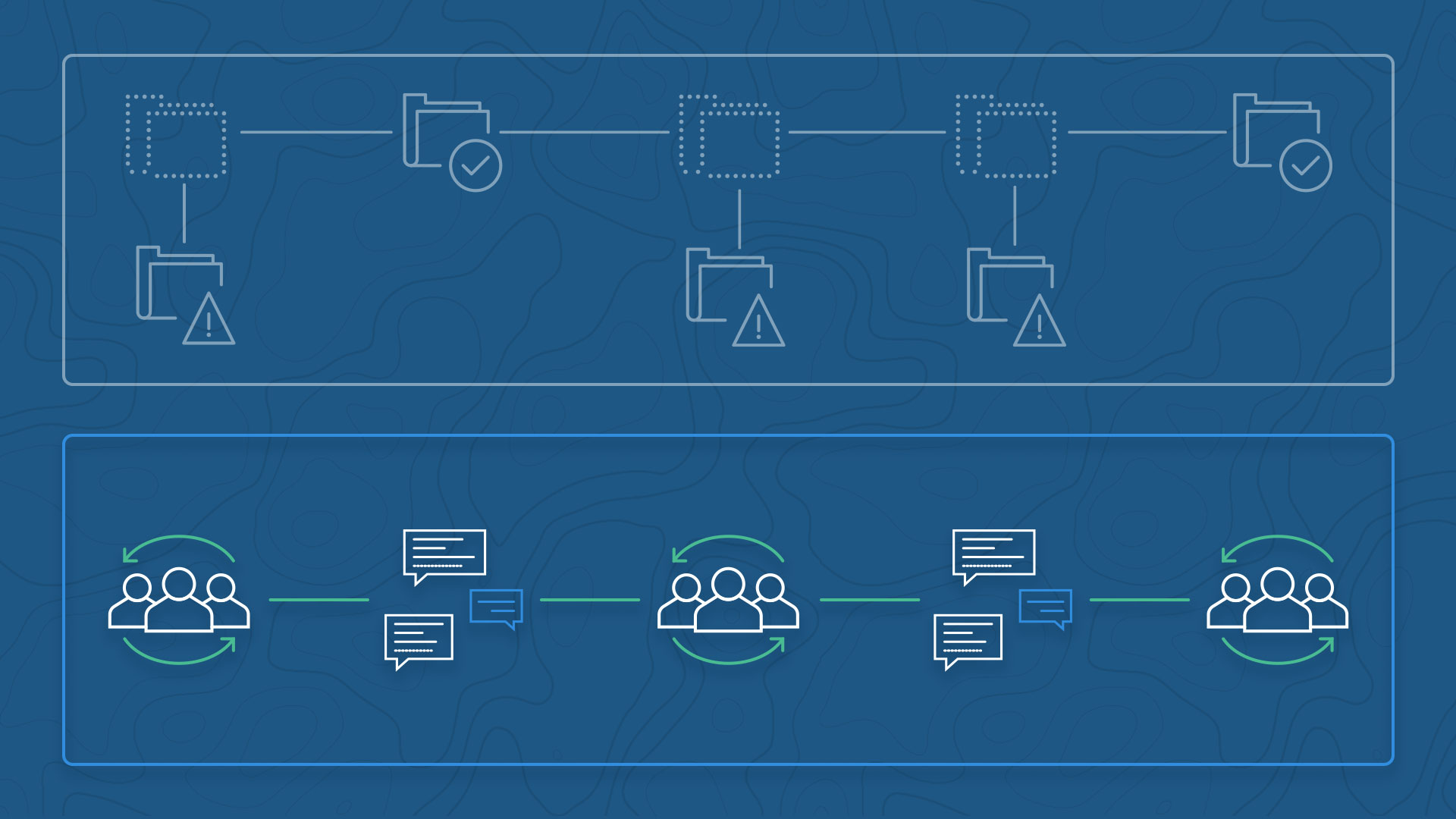

At LeadingAgile, we have distilled the concepts of agility down to the very essentials: Teams, Backlogs, and Working Tested Product. The fundamental unit of agility is a stable, cross-functional Team that has everything it needs to deliver. Backlogs provide clarity on what the team needs to accomplish so that it is always working on the most important things. A high-performing team with a clear backlog can frequently deliver Working, Tested Product.

At the scale of an enterprise, these same concepts become Structure, Governance, and Metrics. We create a Structure of Portfolio, Product, and Delivery Teams aligned to value. We define the Governance rules that control how value flows through that Structure. At each step, we have a set of Metrics that show how the system is operating and whether the objectives are being achieved.

IMPLEMENTING YOUR INVESTMENT STRATEGY & INVESTMENT TEAM

This is where the investment strategy comes to play. When we are mature enough in this system, we can fund it based on products and not projects. Fundamental to this is creating an Investment Team (larger organizations may have more than one).

An Investment Team is a group of executives responsible for setting the company’s overall direction in a language the System of Delivery can optimize against. This team is cross-functional like all the other teams and meets on a monthly and quarterly cadence to gauge the quality of strategic themes and the progress towards achieving them.

This team resolves prioritization concerns from portfolios, makes high-level tradeoffs, and applies resources to constraints to improve flow when bottlenecks are identified. The Investment teams focus on ensuring that the System of Delivery (SOD) can align with overall business objectives using OKRs (Objectives and Key Results) and that the supply in the SOD matches the ambition of the objectives. The team is responsible for the overall decisions on funding & capacity within the portfolios.

The Investment Team creates a new way of working, a system inherently designed to align business outcomes with crisp execution. This system is characterized by clear decision boundaries and rapid feedback and response. In addition to delivery structures, it creates a business structure focused on becoming risk and dependency-aware, balancing capacity and demand, making work visible, ensuring predictable throughput, and identifying high-value items:

- Implementing OKRs at the top level of the organization to establish business goals and outcomes rather than solutions and outputs to drive the conversations.

- Establishing a capability-based foundation for knowledge, decisions, and feedback.

- Utilizing asset allocation mix strategies to respond to market demands and achieve business outcomes.

Annual budgets are a given–the company must plan its finances on an annual horizon. But we can create a system of Structure, Governance, and Metrics that, guided by an Investment Team, can rationally allocate resources against objectives and break the vicious cycle of a year defined by projects rather than value.